Published at 09:23 on 18 August 2012

Note to all: avoid iTunes videos that you must pay for like the plague.

I had been wanting to watch some Portlandia episodes , and last night tried to with iTunes video. Big, big mistake. After charging me $2.99 and commencing the download, iTunes sneeringly informed me that I could not watch said video on my computer, and then launched into a paragraph of arcane technobabble that even I could not understand at first.

Apparently, some lame copy-protection scheme mandated by the Hollywood studios considers all but a select few Macs a piracy threat, presumably because the digital video signal going between the system unit and the monitor could be used to create a decrypted, free copy of the video.

Of course, that’s no excuse for iTunes’ bait-and-switch behavior. iTunes could obviously tell if the system it was running on was unacceptable to Hollywood (hence the message); there’s no reason whatsoever for not sending it before you pay for a video and start the download. None except pure greed on Apple’s part, that is.

While researching the issue, I came across a comment in passing that mentioned BitTorrent and pirated copies of videos. A light went on. I downloaded BitTorrent, downloaded an AVI video player, typed in a few Google keywords, and within a matter of minutes BitTorrent was merrily downloading the content Apple had previously defrauded me for. Content which actually played.

And the BitTorrent download proceeded far faster than the iTunes download had. Just for yucks, I tried it again with another episode and that one arrived promptly and without issue, too.

Way to go Apple and Hollywood: you’ve successfully made it so difficult and risky for customers to pay for content that they opt for the easier option of pirating it instead.

Published at 08:19 on 30 May 2012

And that’s that the ill-considered initiative measure to privatize liquor sales in Washington State is certain to increase prices. The Establishment media is at this late hour, one week before the state liquor stores close for good, starting to feebly offer the caution that prices “might” go up.

Really, now, how couldn’t they? One of the measure’s selling points, trumpeted by its advocates, was that it would not reduce revenues to the state; the legislation was crafted to be revenue neutral. And capitalists are capitalists: in the retail liquor business, as in any business, the goal of business is to make a profit.

So, the state is still making its profit. To that picture, we now add capitalists taking their cut. Just where is that money going to come from? Does anyone honestly think the new for-profit liquor stores are going to harvest C-notes from a secret orchard of money trees and make their money that way? This is not rocket science we are talking about.

Sure, some of it is going to come from union-busting and pushing worker pay down. But that can only go so far. The advocates of paying workers less always overestimate the profits for owners that this will generate.

In short, prices will go up. It’s as close a thing to a future certainty that a simple economic analysis can predict.

Published at 19:08 on 20 April 2012

My new apartment is an a ZIP code that is very ethnically and economically diverse. There’s areas that are in a historically low-income, majority-minority neighborhood, and there’s areas (not far away) which are thoroughly bourgeois, where palatial homes enjoy sweeping lake and mountain views.

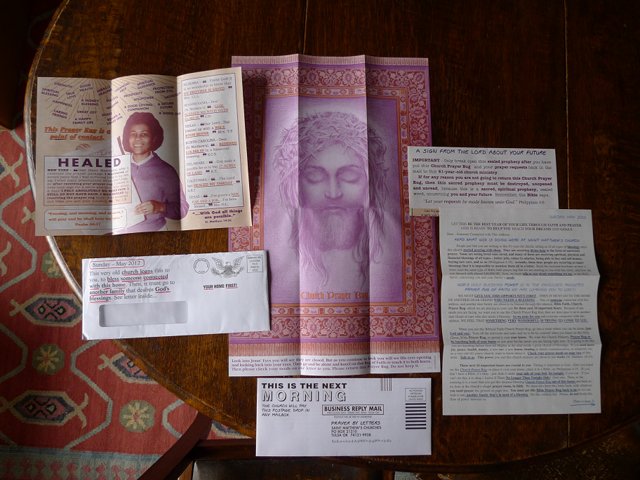

It seems this diversity is allowing me to get a glimpse into how con artists prey on the disadvantaged and vulnerable. Witness the very strange junk mail I received from the so-called “St. Matthew’s Churches” of Tulsa, OK (complete with a cheesy paper “prayer rug” that I’m supposed to have a spiritual experience with because of an optical illusion about Jesus’ eyes opening), promising financial riches to all who send in their prayers.

Not surprisingly, they are very well known scam outfit.

Published at 22:20 on 28 March 2012

I never realized how completely they were until I started studying the things. I mean, sure, they’re a racket because those of us with relatively more money can more easily defer present consumption in the name of savings than those who spend all their income on essentials. They’re classist, in other words. But it goes beyond that.

My new employer offers them as an option, and I thought they might be useful for the things that insurance does not cover. That is, I thought they might be useful until I started reading the fine print: once they have your money, you will never get it back. You either spend it on health care within an appointed period of time (no rollover allowed), or you lose it. Entirely.

You thought the Ferengi Rules of Acquisition were pure TV fantasy? Think again. Ferengi Rule No. 1: Once you have their money, never give it back. Sound familiar?

To that bit of nastiness we can add how there are multiple health-care savings plans, all complex, and all differing in complex ways. It’s as awful as health insurance plans themselves: those offering the plans deliberately make them complex so as to make it impossible to hold all the details in one’s mind at once and make a proper comparison between different options.

Published at 09:14 on 17 February 2012

That’s what nanosecond trading amounts to.

There’s this whole world below 650 milliseconds. It’s like landing on another planet

Looks more like a whole new world of social parasitism on the part of the capitalist class to me.

What value to society does this produce? None, so far as I can see. For the sake of this discussion, let’s be generous to capitalists and take their claim of financial markets being the most efficient way to raise capital at face value. Market forces which are said to work just fine at time scales that humans can perceive (in fact, that’s the scale that all the economic analyses capitalism fans cite as evidence in favor of the utility of such markets work on). There is absolutely no need to go beyond that, and going beyond that consumes labor and resources that could be devoted to producing genuine value.

In fact, by making it more difficult for humans to understand financial markets, such trading actually destroys value, so it is indeed nothing but wasteful social parasitism. There’s actually an effective reformist measure that would put a swift end to it: having a tax on the value of every financial transaction, as France is proposing to do. That would be harmless to long-term investing but take an onerous bite out of short-term trading frenzies.

The question is if and whether it will happen. Those who run markets are sufficiently in the laissez faire mindset that it is ideologically inconvenient for them to be able to see how market forces have naturally evolved in such a way as to destroy value, and to admit the need for intervention to correct this. On the other hand, capitalists have, when presented with the choice between ideological purity and either profit maximization or self-preservation, tended to consistently choose the latter over the former.

Published at 18:54 on 16 February 2012

After the strikers in Longview made it clear that they were willing to ignore the Establishment’s laws if management also was (it’s a little thing called contract breach), and after they were planning to escalate the confrontation further by inviting the Occupy movement to take place, suddenly the Establishment started to get interested in honoring that existing union contract.

Not because it was the honorable thing to do, mind you, but because they were starting to see how failing to do so was going to end up costing them more than agreeing to do so.

So it has always been: if you look at the times when the Establishment has passed reforms that blunt the fangs of capitalism, it has always been during times when there has been growing radical sentiment: the Progressive Era happened when the IWW and the early Socialist Party were going strong (and it’s main exponent, Teddy Roosevelt, got into the White House because his predecessor was assassinated by an anarchist), the New Deal happened at the height of the Communist Party, USA (why do you think it was so easy for Senator McCarthy to find so many people who had attended Communist Party meetings?), and the Civil Rights era in the Sixties also happened against a groundswell of radical movements.

And indeed, it’s also why the Establishment media tries as hard as possible to smear the Occupy movement by continually focusing on its problems. They know what forces them to kick down concessions, and they don’t want to have to do that.

Published at 17:46 on 7 February 2012

So, Americans are borrowing more and this “could be a sign that Americans are more confident in the economy”. Of course, the very next sentence contains the catch: “consumers are also borrowing more and saving less at a time when their wages haven’t kept pace with inflation.”

In other words, it’s the same old capitalist Ponzi scheme that’s been playing out since the 1970s: declining unionization, stagnant or declining wages, and increased debt taking the place of increased wages when it comes to consumer spending.

Maybe the capitalists will again figure out how to make it last a few years before it collapses yet again, just like real estate and tech stocks did. Big deal. Anytime money is borrowed, it has to be paid back. This Ponzi scheme will collapse just like the previous ones did.

And each time the newest scheme collapses, it does so harder than the last collapse. So it will continue until either the capitalist class realizes that income inequality threatens the capitalist system itself, or the reemergence of class consciousness prompts the ruled to successfully rebel against their rulers.

Since we’re nowhere near either point at the present time, expect the boom/bust cycle to go through at least one more iteration.

Published at 20:50 on 28 January 2012

Really, it’s amazing how crappy computer keyboards generally are. I was just at Fry’s getting the capacitor I’m going to try replacing, and had a chance to try out their keyboard selection.

The dominant “rubber dome” technology provides absolutely horrible tactile feedback: the electrical action takes place after the main mechanical action that one feels. Therefore, the only recourse if you want to type quickly is to bang on the keyboard like crazy, to ensure each key stroke hits home and causes a character to be entered. This causes fingers to get much more tired than they need to, because one is exerting on average far more force than one needs.

The only keyboard technologies that provided proper tactile feedback were ones made using IBM’s “buckling spring” technology (which I think is the best), and some mechanical keyswitches (which can get pretty darn good, too). Every subsequent technology has had no advantages for the user whatsoever: the only advantages newer keyboard technologies have has been for the manufacturer’s drive to cut costs.

What astounds me is not that the cheapest keyboards feel like crap (one would expect that, you’re getting pure “dollar engineering”), but how many keyboards with $100-and-up price tags (even ones advertised as “ergonomic”) also felt like complete crap when I tried them. Making a fancy curving layout so one’s hands can be held at a natural angle but using a technology that forces (at the cost of failing to enter the random character) users to use unnecessary force is like having a restaurant that serves a turd as dessert, but frosts it elegantly in icing and serves it on a sterling plate.

The only keyboards that weren’t absolute crap were two models by Razer geared towards the gamer crowd. While spendy, they were still less expensive than many of the crappy ones.

Published at 11:34 on 11 January 2012

While looking at The Guardian’s website this morning, I noticed an ad for an on-line auction company called QuiBids, which listed some about-to-close auctions with temptingly low bid amounts.

Realizing that it might be too good to be true, I decided to investigate a little. Because, on the other hand, if it’s not some sort of sleazy ripoff site that charges you simply to place a bid (whether it wins or not), even if only a small fraction of the items go for pennies on the dollar, it could really pay to keep an eye on things and slap bids on anything that looks like it’s going to sell for a song. I probably wouldn’t win every time, of course, but at those prices it would be worth celebrating the wins and ignoring the ones that got away. It’s hard to do this sort of thing on eBay anymore because that site has simply become too popular, but perhaps this site is new enough that such opportunities can still be found. Or so I thought.

Was I ever prescient. Turns out it is a sleazy ripoff site that charges 60 cents per bid, whether or not the bid wins. Worse, you have to buy a ridiculously high number (100, $60 worth) of bids up-front before you can use the site. And the shit icing on the cake is that you have no choice of bid increments: you can only make pathetic, penny-ante bids at a fixed amount dictated by an algorithm on their site.

I know enough about how “baby bids” work on eBay when you make them (or rather, don’t work) to know that this makes the site a complete ripoff. How much do you want to guess what the odds are that once you give them your $60, you’ll find that mysteriously there are no items about to sell for a song like their ad shows? My guess is pretty darn near 100% odds.

Published at 14:36 on 22 December 2011

… when reading a Craigslist job posting titled “PHP Programmer & Fine-Code Connoisseur // $110,000 (Seattle)”. PHP is a textbook example of the hazards of someone who has insufficiently studied language design designing a language. No genuine “fine-code connoisseur” would want to touch PHP with a 10-foot pole.

The unrealistic salary indicates that it’s a pretty transparent example of a sleazy recruiter trolling for résumés. PHP jobs tend to pay less than those using most other platforms, precisely because anyone with enough smarts to be a good programmer doesn’t want to touch the language.